Wealth happens in three primary ways:

- Earn money – This usually happens from the jobs we do or the businesses we own.

- Save money – Saving our money is how we keep the money that we earn.

- Invest money – Putting our money at risk to build wealth over time.

Most people focus entirely on #1 and ignore #2 and #3, but only at their own peril.

Former boxer Mike Tyson, NBA stars Scottie Pippen and Dennis Rodman and PGA golfer John Daly are prime examples of what can happen when your spending runs out of control. In the case of John Daly, he lost nearly $90 million due to gambling. If you think spending doesn’t matter, you’re wrong.

In fact, reckless spending is a primary reason why people have a hard time building wealth.

The Wealth-Building Equation

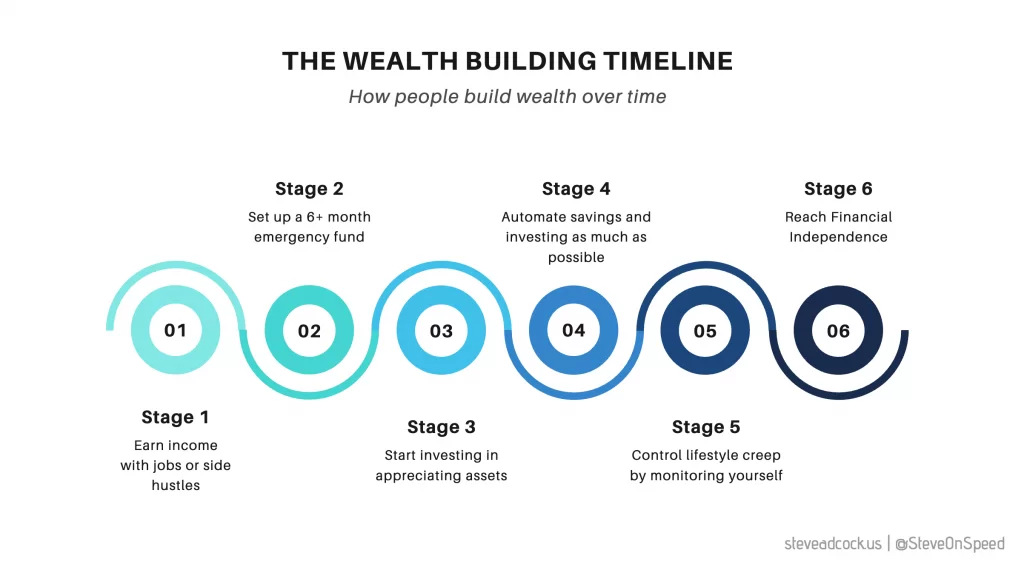

Wealth builds over time, and it generally follows a very basic process.

It’s called the Wealth-Building Equation.

Stage 1: Earn income with jobs or side hustles. Unless you’re the fortunate beneficiary of a large inheritance, it’s impossible to build wealth without earning an income. The larger the income, the more growth potential.

Note that you don’t need to earn a big salary to achieve financial independence or retire early, though it will take longer to build wealth with smaller salaries. That’s okay. This is a process, not a race.

Stage 2: A 6+ month emergency fund. Building an emergency fund should come before investing – and definitely before spending on things that are not essential to your life. An emergency fund of at least six months means you can endure most financial emergencies, sudden job losses or anything else that necessitates a quick and big cash expense.

If you don’t have an emergency fund, start one today. Start small. Save as much as you can. The key is to start building it NOW.

Stage 3: Start investing in appreciating assets. Over time, investments are what builds wealth. Like I say in my eBook Big Money, there is always a risk associated with investments, but investing over the long haul is how most people build enough wealth to achieve financial freedom.

Stage 4: Automate savings and investing as much as possible. Take the discipline out of the equation by setting up automatic transfers to fund your investments. This is also a good technique to use when building up your emergency fund, and most banks offer recurring money transfers.

If your employer offers a 401(k) or IRA, then use the payroll system to automatically contribute into those retirement account.

Stage 5: Control lifestyle creep by monitoring yourself. Be honest with yourself about how you spend your money. Inspect your bank and credit card statements and understand every expense.

Our lifestyles have a way of expanding as we earn more and more money. This process is called lifestyle creep (or inflation), and it eats away at our wealth. This process is not about being judgmental.

It’s about caring enough about your future to reign yourself in.

Stage 6: Financial independence. Congrats, you’re there! But, don’t let your guard down. It’s possible to fall out of financial independence if we let our lifestyle get too expensive or extravagant.

To distill, wealth builds through a process: Earning -> Saving -> Investing.

It works.